Loans private financing cleveland oh company is noninstitutional lender that problem short-term loan products for the buy of, and the renovation sometimes, an investment property. They’re known as “hard money loan companies commonly.” These private money loan companies offer private money loan products to short-term fix-and-flippers and also long-term investors searching for a rehab project, fast funding, or cash-out refinancing.

How Private Money Loan companies Work

Private money lenders offer loans which are secured by a property asset typically. These loans are accustomed to purchase a homely house, multifamily or condo building. Private money loan companies can be anyone from the personal friend to a recognised private lending organization and are therefore known as “relationship-based” loan companies.

However, when people consider private lenders, they’re most discussing hard money lenders typically. It is because hard cash lenders issue short-term property loans used to get and renovate an expense property. Hard money loan products are best for both short-phrase fix-and-flip investors and also long-term buy-and-hold investors. We discuss who private loan companies are right for in the area below specifically.

Still, you can find three examples of private lenders technically. Each one of the three degrees is founded on the partnership between your borrower and the lending company.

The three examples of private money loan companies are the following:

Primary circle: Family & friends

Secondary circle: Co-workers, professional & personal acquaintances

Third-party circle: Accredited traders & hard money lenders

Hard money lenders are believed to be “third-party” personal lenders, that is the furthest from a borrower when it comes to relationship. However, hard cash lenders are the best private loan companies because they’re probably the most reliable and also have standardized interest rates, costs, fees, and mortgage terms.

In this article, we specifically discuss hard money lenders as personal lenders. It is because hard money loans routinely have short loan conditions between 1 - three years, interest levels between 7% - 12%, and lender fees between 1.5% - 10%. Conversely, personal lenders in a customer’s main or second-level circles have loan conditions, rates, and expenses that widely vary.

Who Private Money Loan companies are Right For

Private money lenders are usually predominantly correct for short-phrase fix and flippers who wish to compete with the brief timeline of an all cash buyer. However, personal loan lenders may also be right for long-term traders who wish to rehab accommodations property before refinancing right into a permanent home loan or seasoning a house before refinancing.

Personal money lenders are correct for the next types of people:

Fix-and-flippers thinking about purchasing, renovate, and market a house within 1 year.

Short-term and long-term traders who need financing rapidly.

Buy-and-hold investors thinking about purchasing and renovate a house before refinancing with the standard mortgage.

Long-term investors who have to season the property

Personal lenders often concern loans to short-phrase investors looking to earn money flipping houses. Personal lenders also problem both rehab loans and also traditional hard money loan products to buy-and-hold investors thinking about purchasing and/or renovate accommodations property.

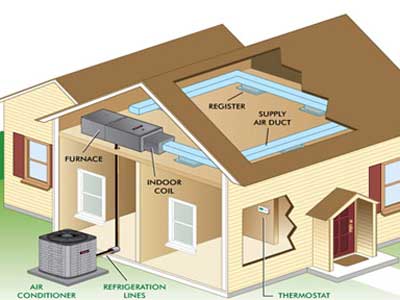

From heating and cooling to electronics and appliances, it takes a lot of energy to power our daily lives. Our homes use 37 percent more energy today than they did in 1980. But without energy efficiency -- through technology innovation and federal energy conservation standards -- this number would be a lot higher. In fact, even though our total energy use has grown, our energy use per household is down about 10 percent, despite that our homes are larger and contain more devices.

From heating and cooling to electronics and appliances, it takes a lot of energy to power our daily lives. Our homes use 37 percent more energy today than they did in 1980. But without energy efficiency -- through technology innovation and federal energy conservation standards -- this number would be a lot higher. In fact, even though our total energy use has grown, our energy use per household is down about 10 percent, despite that our homes are larger and contain more devices.